Yaron Hazan (yarok02@yahoo.com) is VP of Regulatory Affairs at ThetaRay in Hod HaSharon, Israel.

Research shows that the use of technology in the business sector has two main purposes: (1) improving the efficiency of successful current processes by automation and (2) replacing or totally changing the methods used to significantly improve the performance of a process. Creation of such technology is also known as disruptive innovation (i.e., the introduction of a new method unlike old practices or a new product type). A well-known example for such evolvement is the way we consume music: vinyl albums and cassette tapes evolved to CDs, which then evolved to MP3s, and then to streaming on YouTube or music apps.

In this article I will discuss the role of technology in compliance and its evolvement, since it plays a significant role in compliance-related activities. Its role will continue to grow due to the following trends:

-

Large institutions are enlarging the size of data they own and manage, giving way to what has become known as the “data era.”

-

Human interaction is decreasing, and more interactions are completed electronically.

-

Products and services, current and new, are being offered in an electronic channel.

-

COVID-19 is affecting the way we consume products and services.

I will focus on the financial industry for two main reasons:

-

It has been heavily regulated for decades, so it provides enough facts to support ideas and assumptions from a research perspective.

-

It also has gone through dramatic changes that influence other industries regarding how compliance programs are designed and executed.

Additionally, I will specifically focus on financial crime compliance (FCC), which covers anti-money laundering, counterterrorist financing, sanctions, anti-bribery, and corruption.

Compliance technology tools: A brief overview

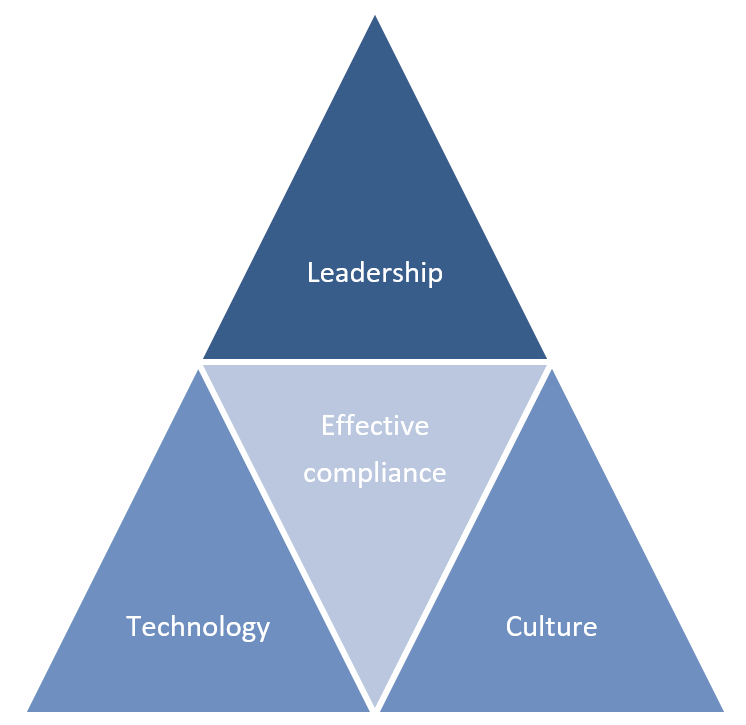

My experience has taught me that to form an effective compliance program, three fundamentals, including technology, should be in place. The compliance triangle (Figure 1) illustrates these elements: leadership, culture, and technology—leadership to navigate the organization in the right direction, culture to embrace the importance of values, and technology to enable effective and efficient outcomes.

In a similar manner to the evolution of music consumption described earlier, we can see the broad evolution of the use of technology in compliance as follows:

-

Excel sheets,

-

Semi-automated workflows, also known as business process management (BPM),

-

Rule-based scenarios (used to identify specific events in the data),

-

Machine learning, and

-

Artificial intelligence (AI).

Excel sheets and BPM workflows work to improve efficiency, provide workflow management, and list the compliance risks and controls. They provide important value when many details need to be incorporated into the process and support the business while aligning the expected controls with tasks in the compliance risk management framework, including ensuring completeness. BPM tools are a key component of the implementation of a compliance program, as they enable an organization to have full confidence that complex processes are including the relevant controls. For example, customer onboarding includes many forms, questionnaires, and due diligence. Rule-based scenarios were designed to monitor specific risks according to predefined thresholds.

With the arrival of machine learning and AI, we now get a more sophisticated view than we would with spreadsheets, BPM, or rules, but the purpose is the same: to assess risks and map controls in the compliance risk management framework. AI, specifically, serves all purposes and can ultimately improve risk assessment, efficiency, effectiveness, and governance.

With increasing regulation, bad actors are constantly innovating in tighter market conditions; financial institutions are attempting to adopt the automation route at a fast pace to fight financial crime.